Stocks mixed as earnings and tariffs vie for attention

- Wall Street ends down slightly as tariff uncertainty keeps investors on edge

- Dollar halts sell-off versus yen, AUD and GBP still rebounding

- Treasury market catches breath before retail sales and Powell

- Gold pushes higher on continued safe haven buying

FX: USD made gains as it tries to bounce off strong long-term support from the July 2023 bottom at 99.57. Initial weakness was pared after reports that China ordered a halt to Boeing jet deliveries as the trade war expands, according to Bloomberg citing sources. Fed Chair Powell will speak later today with a speech on the economic outlook. Options markets are sending clear signals that markets remain heavily bearish on the dollar, with a deterioration in US data coming soon plus the chaotic recent policy making weighing on the buck, even if severe market dysfunctionality has been avoided for now.

EUR underperformed most of its peers except the CHF and CAD as it gave back some of its recent strong gains. A long-term Fib retracement level of the early 2021 to September 2022 low is at 1.1274. German ZEW business sentiment data was mixed with current conditions missing forecasts and economic sentiment contracting. The figures highlighted that erratic changes in US trade policy are weighing heavily on German expectations.

GBP is the second strongest major this week after the kiwi. Cable made another fresh cycle top at 1.3251, a level last seen in September 2024. Trade updates on the US-UK front have been constructive with talks said to be making good progress. UK jobs data was mixed, with eyes on today’s inflation figures.

USD/JPY printed an inside day, denoting a narrow trading range ‘inside’yesterday’s high-low range. The more positive risk environment is not seeing as much yen buying and the 10-year Treasury yield has been falling this week.

AUD enjoyed a fifth straight day of buying as it rebounded strongly after its sharp spike lower last week. The improved risk mood is helping along with hopes of China stimulus. The latest RBA minutes provided little fresh clues as it stated it was not yet possible to determine the timing of the next move in rates and it was not appropriate at this stage for policy to react to potential risks.

US stocks: The S&P 500 lost 0.17% to settle at 5,396. The tech-heavy Nasdaq finished up 0.24% at 18,842. The Dow closed 0.38% lower at 40,368. One of the worst-performing sectors was consumer discretionary, a clear signal that investors are becoming more discerning and no longer selling indiscriminately but beginning to assess the longer-term implications of the trade war. Financials did well with Bank of America adding over 3.6% and Citigroup 31.7% on strong earnings. Johnson & Johnson slipped 0.3% despite beating analyst estimates while Boeing slid 2.3% after reports that Beijing instructed Chinese airlines to halt new jet order, escalating trade tensions further between the world’s two biggest economies.

Asian stocks: Futures are mixed. APAC stocks traded generally higher after gains Stateside. Sentiment was underpinned by the recent US tariff exemptions and dovish comments by the Fed’s Waller. The ASX 200 saw strength in healthcare and financials but there were very few clues from the RBA Minutes regarding when the next rate move will occur. The Nikkei 225 outperformed with automakers among the best performers in the index after Trump’s potential temporarily exemption of the auto industry from tariffs. The Hang Seng and Shanghai Comp lagged, with investors still cautious after the US announced probes into pharmaceuticals and semiconductors.

Gold found a small bid as it printed an inside day after three successive intraday record highs. The current high point is $3,245 with initial support at the prior swing high at $3,167.

Day Ahead – China Q1 GDP, UK CPI, US retail sales

China’s Q1 GDP growth is seen easing to 5.2% y/y, with the quarterly rate falling to 1.3%. The report is expected to show stimulus is working, but with trade headwinds, further policy support is expected. Economists say slower net exports likely outweighed modest gains in domestic demand.

Headline UK CPI is forecast to tick one-tenth lower to 2.7% due to falling fuel prices and core CPI to 3.4% y/y. Services inflation is likely to ease slightly to 4.9%. Risks are tilted to the upside, especially in the months ahead when the headline is predicted to jump to 3.5%+ y/y in April. That matches the BoE forecast but could remain high into year end. There are currently around 80bps of rate cuts priced into 2025.

US retail sales will offer a view into how much economic anxiety may be impacting consumer spending already. February saw only a modest bounce back as consumers curbed spending while consumer confidence indicators have sunk. Consensus see growth of 1.3%, a big jump due to buying brought forward ahead of tariffs, especially in auto sales.

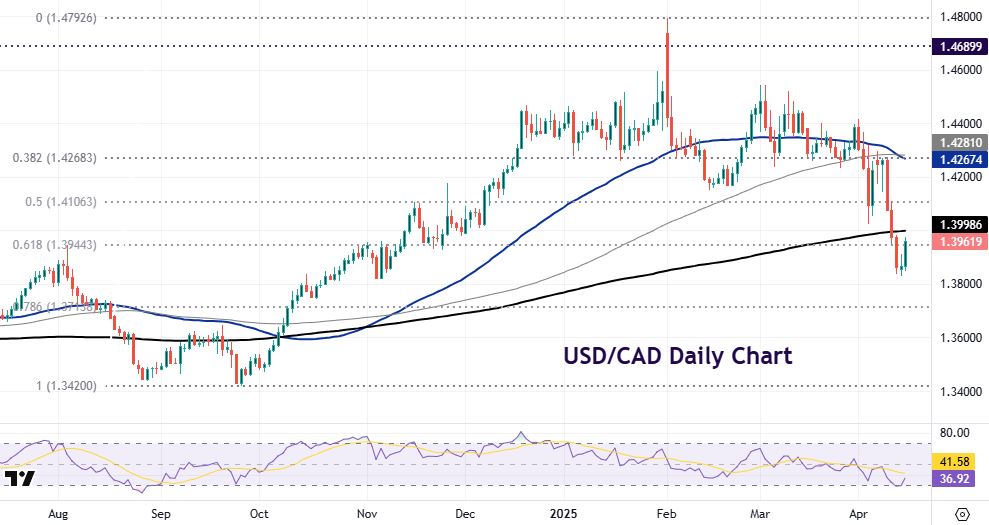

Chart of the Day – USD/CAD rebounds ahead of likely rate cut

Markets are pricing in around 10bps of easing into this meeting, and analysts are even more split. Tariffs are obviously the big uncertainty, though rates are currently at the midpoint of the neutral rate estimate (2.25 – 3.25%). A pause in trade tensions and hopes of a sustained global recovery could mean the BoC goes slow, though the latest labour market data was concerning, and yesterday’s CPI was softer.

After breaking down below 1.39 last week, prices have picked up over the last two days with cooler CPI seeing loonie selling. The 200-day SMA sits at 1.3998 above, with the midpoint of the September to January rally at 1.4106. Monday’s low is 1.3827.