Stocks enjoy Fed in wait-and-see mode, BoE next up

- FOMC sits on its hands, lower growth and raises inflation projections

- Stocks strengthen as Fed predicts two rate cuts this year

- Dollar, treasury yields weaken after monetary policy move

- Gold makes fresh all-time highs, extending rally to over 16% ytd

FX: USD moved mildly lower on the cautious Fed statement, dot plots and Fed Chair Powell’s press conference. Rates were left unchanged as expected with the median dot plot projecting two 25bps rate cuts this year. That meant it was adjusted in a hawkish direction, but the market focused more on growth risks, with forecasts revised lower. Uncertainty was obviously emphasised in relation to tariffs and fiscal policy. as we said earlier in the week, there was an air of stagflation in all the adjustments. The dollar will likely push down into recent support around 103.20.

EUR regained some of its losses as Fed Chair Powell spoke in his press conference. The euro had sold off initially with intraday volatility probably influenced by sharp swings in Turkish markets. The recent high is 1.0954 with initial resistance above around 1.10.

GBP alsoclawed back losses on the day through the Powell presser. Sterling followed the broader risk sentiment again, ahead of today’s jobs data and then BoE rate decision. The MPC will sit on its hands but hints about a cut at its next meeting will be crucial. A cautious stance is expected with inflation still elevated.

USD/JPY was volatile around the BoJ meeting, drifting higher on dollar strength. The bank unanimously voted to keep its policy rate unchanged at 0.5%. Governor Ueda did not indicate when the next rate hike might occur but emphasised the Bank’s commitment to its normalisation strategy. The major then turned lower in the US session, dropping sharply as the US 10-year yield slid. The target for yen bulls will be 147 after failing to break higher.

AUD fell back for a second straight day and traded around the 100-day SMA at 0.6348. there was little reaction to the domestic Leading Index data. USD/CAD nestled just above 1.43 The trim and median core measures remained below 3.0%, though beat estimates. Support sits at 1.4368.

US stocks: The S&P 500 added 1.08% to settle at 5,675. The tech-dominated Nasdaq finished up 1.3% at 19,736. The Dow rose 0.92% to close at 41,964. The benchmark S&P 500 is now up 2.78% from its 2025 closing low last week. Tech led the gains while all 11 sectors rose. Volumes were slightly less than average. Fed Chair Powell has form in soothing stock market worries and this happened again at this FOMC meeting. But the April 2 reciprocal tariff day looms large.

Asian stocks: Futures are mixed. APAC stocks traded mixed on Wednesday after the negative handover Stateside and ahead of the day’s central bank meetings. The ASX 200 was subdued for most of the session and closed lower. The Nikkei 225 initially benefitted from recent currency weakness, briefly reclaiming the 38,000 level. However, gains were pared following the lack of surprises from the BoJ’s steady decision to maintain rates at 0.50%, The Hang Seng and Shanghai Comp were choppy with participants cautious as they digested recent earnings releases. Tech stocks were contained heading into Tencent’s results due later.

Gold continued higher, pushing to a new record high at $3045. Uncertainty is still evident even with the modestly improved risk mood.

Day Ahead –Australia Jobs and BoE Meeting

The Australia employment report is expected to show 30,000 jobs added in February, a marginally slower pace than the 44,000 in January. The unemployment rate is predicted to stay steady at 4.1% after January seasonal distortions pushed that figure higher. The latest RBA meeting saw a cut in rates by 25bps, taking the cash rate to 4.1%. However, it was seen as a “hawkish cut” due to the guidance given.

The BOE meeting is preceded by the UK jobs data. This has been characterised by stubborn wage growth, a key metric for the MPC, which is expected to remain unchanged at 5.9%. Policymakers will keep the base rate unchanged at 4.5% with a 7-2 vote split forecast. Sticky inflation, with services prices pushing up to 5% is the main worry, as January growth went negative. The former will likely be the focus and mean rate setters keep to a “gradual and careful” approach to policy easing.

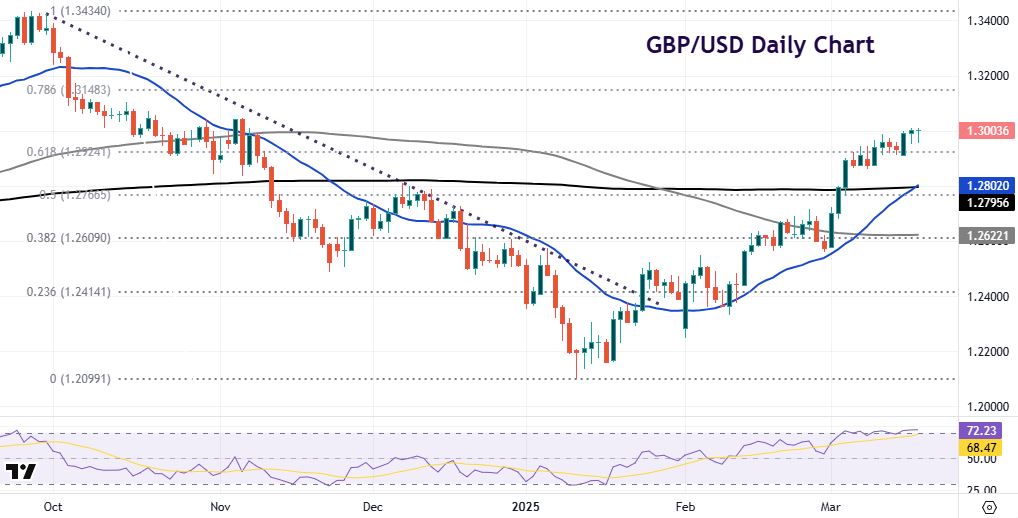

Chart of the Day – Overbought GBP/USD continues higher

BoE officials will keep their options open at today’s meeting. That means likely one 25bp move every quarter as the MPC watch the labour market that is gradually loosening, while price pressures stay elevated. They also have to add global trade policy tensions and domestic fiscal policy changes into the mix, with next week’s Spring Budget a major risk event.

Money markets are pricing in around 52bps of rate cuts for 2025. A more dovish bias by the bank, concerned with stagnant growth, could hit sterling’s recent run to four-month highs versus the dollar. This currently looks mildly overbought, though more good news out of Germany could see cable push above 1.30. The next upside target is 1.3148 and support sits at 1.2924 – a major retracement Fib level (61.8%) of the September/January decline.