Stocks bid, dollar down as risk events get closer

* President Trump says will speak with Russia’s Putin on Tuesday

* Dollar dented by economic worries, European FX remains in favour

* Gold holds around $3000 ahead of Fed rate decision and updated forecasts

* S&P 500 rises for a second day, tries to continue comeback form correction

FX: USD closed lower and not far off the recent cycle bottom at 103.22. US retail sales were a mixed bag with a soft headline but stronger control group number, which feeds into GDP. The Atlanta Fed GDPNow model was revised slightly higher to -2.1% from -2.4%. This is updated every two weeks and has garnered attention after tumbling in recent weeks. There was little Trump tariff talk, with focus turning to Wednesday’s unchanged FOMC decision and new economic projections.

EUR firmed and is not far off the top from last week at 1.0946. There was little specific news flow, but markets are bracing for the outcome of today’s German vote on fiscal reform. Solid economic data from China, a key export market for Germany, plus Beijing’s ongoing efforts to boost consumption likely caused some positive spillover impact on EUR sentiment.

GBP again tracked the broader risk mood and made fresh cycle highs at 1.2998. This week’s BoE meeting will likely confirm a slow and cautious stance of any rate cuts amid sticky inflation and wage growth. Next initial resistance is around the 1.3042/47 region.

USD/JPY moved up to the midpoint of the September to January rally at 149.22 and the 50-day SMA at 149.17. The yen was the major laggard with a mild risk-on theme through the day and to kick off a jam-packed risk event calendar. The BoJ meeting won’t likely yield any surprises, with markets interested in the bank’s thoughts on wage negotiations and potential reaction function. Japan’s largest labour union anticipates an average 5.5% wage increase this year which would surpass 5% for the second consecutive year and would be the highest in 34 years. But it is still below the union’s 6.09% pay increase demand.

AUD surged through the 100-day SMA at 0.6351 to three-week highs. China activity data was decent and news on plans to boost consumption was taken positively. USD/CAD dropped through its 50-day SMA at 1.4336. Risk sentiment helped the loonie along with an uptick in oil, as Brent looks to build a base above long-term support around $70.

US stocks: The S&P 500 added 0.64% to settle at 5,675. The tech-laden Nasdaq finished up 0.55% at 19,812. The Dow rose 0.85% to close at 41,841. All sectors closed in the green apart from Consumer Discretionary. Real Estate, Energy and Consumer Staples led the gainers. Intel again jumped, adding close to 7% on reports the incoming CEO is considering major changes to manufacturing and AI strategies. Tesla was among the steepest decliners, off nearly 5%, as it consolidates just below the recent low at $217, a level last seen in October.

Asian stocks: Futures are mixed. APAC stocks began the week on the front foot following last Friday’s resurgence Stateside. Encouraging Chinese activity data and a new plan to boost consumption also helped sentiment. The ASX 200 was boosted by strength in the commodity-related sectors and the positive China data. The Nikkei 225 climbed at the open despite the lack of obvious catalysts. The Hang Seng and Shanghai Comp were positive with sentiment underpinned following recent support pledges and after encouraging Chinese activity data. Retail Sales matched estimates and Industrial Production topped forecasts. But gains in the mainland were limited as data also showed an increase in Urban Unemployment and house prices remained in deep contraction territory.

Gold hovered around the $3000 level after its record high on Friday at $3004, and eventually closed at its high on the round number. Central banks keep buying the precious metal, with emerging market central banks recently leading the buying spree. China’s central bank expanded its reserves for a third straight month, despite record prices.

Day Ahead – German vote

EUR is watching expectantly with both eyes on today’s vote in the German Parliament, the Bundestag, on the fiscal reform package. This is scheduled to be passed with the required two-thirds majority and then it goes to the upper chamber, the Bundesrat, on Friday, with expectations for approval. President Merz has stated that CDU/CSU unanimously support the proposal, although there are risks that some may not vote in favour and that Bavaria’s ‘Free Voters’ might not support it in the Bundesrat on Friday.

However, crucially, there has been agreement with the Greens and the package is nearly identical to the original one proposed. The last day of the current Parliament is March 24, with the new one convening a day later. The package and vote are a historical change to the fiscal debt brake, and also an impressive fiscal deal. Positive sentiment and in time, spending will help a cyclical rebound in Europe’s powerhouse economy – hoe long this will last is key for more euro upside.

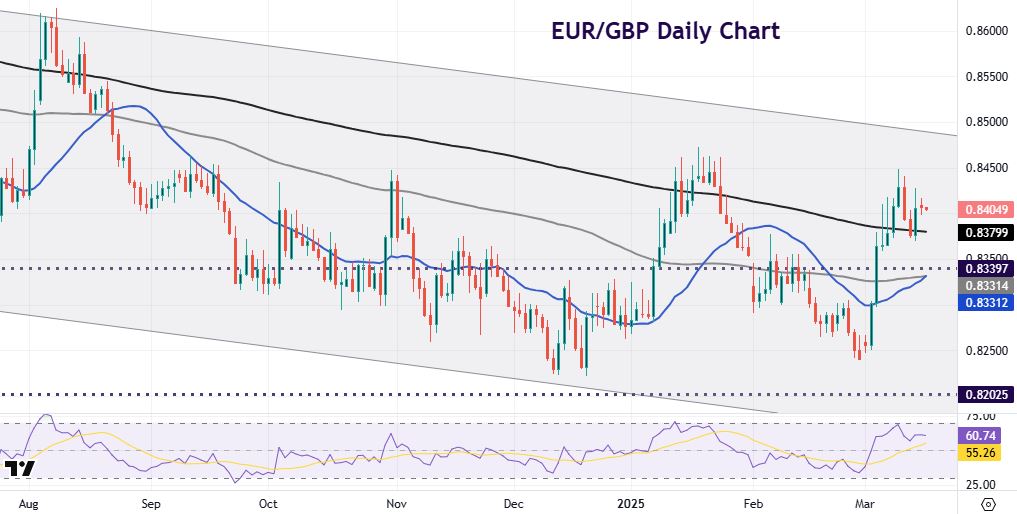

Chart of the Day – EUR/GBP heads into resistance

This pair has been a long-term shallow downtrend since highs from January 2023. More recently, it found support again around 0.8250, and where the December lows also came in. At the start of March, two big days of buying overcame selling after, US President Trump seemed to be more forgiving towards the UK than the EU regarding tariffs. The euro jumped up above another major long-term swing low around 0.8339.

Prices very recently also moved above the 200-day SMA which has capped the upside in the past. That comes in at 0.8380 and could act as initial support. Resistance sits around 0.8450 again, highs from October, January and February.