Weekly Outlook | Dollar strength to continue after the FED?

Important events this week:

As expected, the FED did not cut rates during their meeting last week. Equity markets took this with a pinch of salt and continue to trade in a sideways pattern. Yet, the falling trend had come to a halt and markets could also be prone for further upside momentum. Especially a solution around the war in the Ukraine might be of help. Weaker oil prices and a decline of the Dollar might also add support. About 40% of the companies, which are part of the S&P 500 index derive their income outside of the US. The Dollar weakness might hence boost the demand and sales might rise. Positive data could hence help the index to rise initially.

The purchasing manager indices from Monday this week might also help to boost the EUR further. Any positive data from Germany and France could signal that a positive shift in the economy is under way.

– AU consumer price index– The Australian Dollar had lost momentum again during last week’s trading. The reflection of the AUDUSD currency pair as seen below in the chart resembles the US equity market in particular. Stocks were rising slightly and so was the currency pair. However, the weakness of the Dollar did not help the Aussi to rise further and hence the market might break the major support area soon.

Should the price break the 0.6200 zone a push to lower levels might be seen. With that as well US equities could weaken further. The index form Australia will be released on the 26rd of March, 2025 at 01:30 CET.

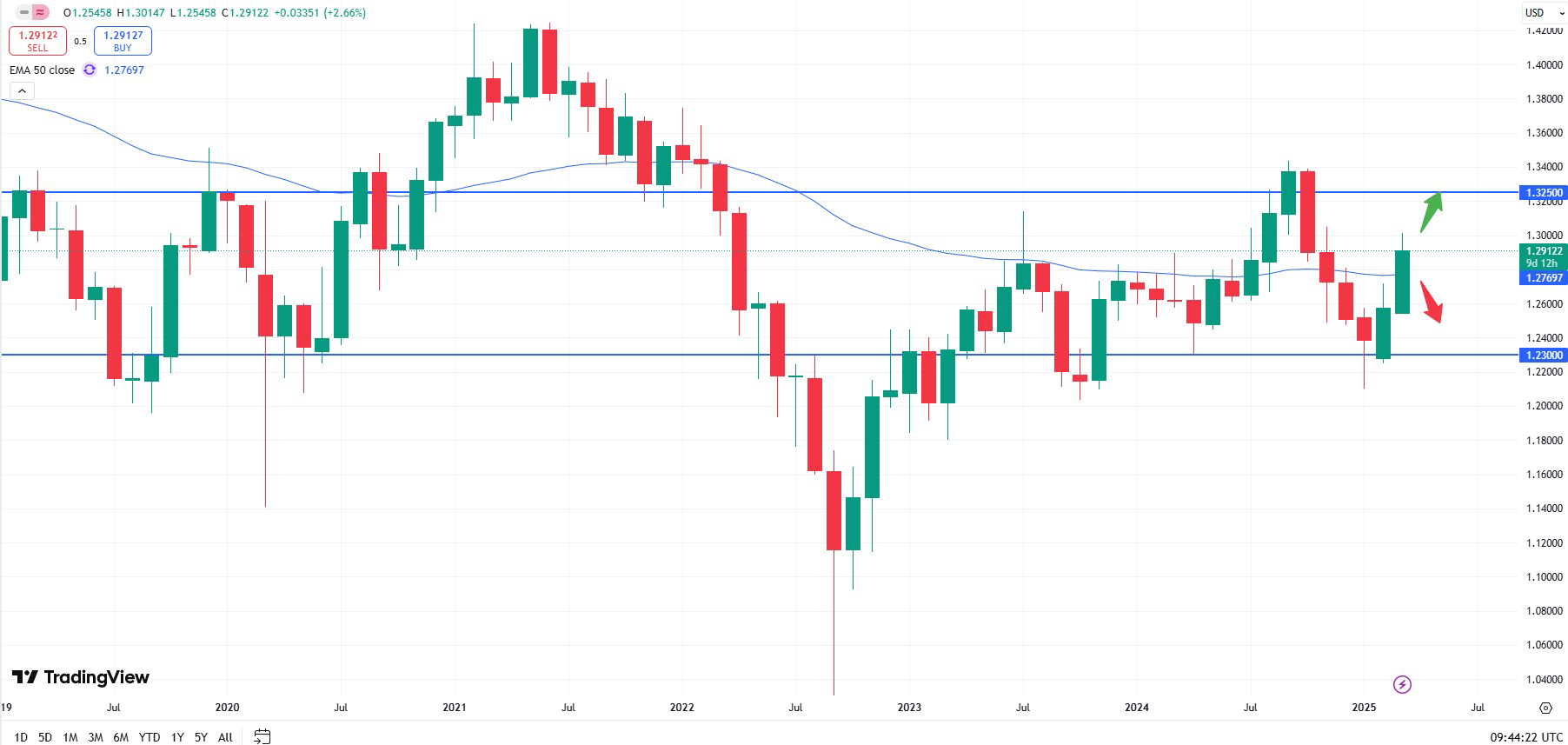

– UK consumer price index– This week, the CPI data is expected to fall back below the 3.0% level. Last month showed, that prices had been rising again sharply from the 2.5% level. This gave the Pound a boost against other currencies but this trend seems to reverse at the moment.

The monthly chart of the GBPUSD currency pair shows positive momentum. After the recent break of the 50- moving average the upside towards the 1.3250 resistance might continue. Retracements to the downside might hence be used for entry opportunities to higher levels. The index form the UK will be published on the 26rd of March, 2025 at 08:00 CET.

– US PCE price index– The important price index is expected to remain steady at 0.3% on a monthly basis. This index is used by the FED as their main source of information to determine the development in prices and hence adjust interest rates.

The monthly chart of the USDJPY currency pair shows that the market might be ready for a bounce higher. Should the price continue to trade above the 149.00 level, a rise in prices might be expected. Rising consumer prices could furthermore help such view, as the Fed would be expected to remain on their current rate path for longer. The index from the US will be published on the 28rd of March, 2025 at 13:30 CET.