USD eases, stocks slide ahead of FOMC and BoJ meetings

- Putin agrees to halt strikes on Ukraine energy facilities but won’t commit to truce

- Germany’s Bundestag votes in favour of reforming “debt brake”

- Dollar lower as markets watch fresh Fed dot plot and economic projections

- S&P 500 fights to stay out of correction territory, tech tanks

FX: USD tested last week’s low at 103.20 ahead of the FOMC meeting. The next major support sits at 102.30. Rising inflation expectations still likely warrants caution by Fed officials on more rate cuts. The latest revision in Atlanta Fed GDPNow forecast for Q1 printed -1.8% from -2.1%. Tariff news has gone relatively quiet as markets perhaps have one eye on the April 2nd date when the US announces more levies. US Treasury Secretary Bessent said those reciprocal tariffs won’t be an automatic 25% plus 25%. We note the 10-year US Treasury yield could be forming a long-term head and shoulders reversal pattern. The neckline and support/resistance sits around 4.14%. The Trump/Putin call was said to be very good and productive.

EUR pushed higher again as Germany passed the debt reform package. The upper house will vote at the end of the week. The huge spending plan ends the history of fiscal conservatism in the country. It is hoped huge military and infrastructure spending will revive the region’s economy. The Dax neared recent record highs. The next Fib level (78.6%) of the September to January drop sits at 1.0991.

GBP hit 1.30 for the first time since November. Again, there is no specific UK news, though Thursday sees jobs data and the BoE rate decision where the MPC will leave rates unchanged at its meeting. There are around 50bps of easing priced in for 2025, versus just above 60bps for the Fed. There are solid trend momentum signals across various timeframes in cable. Next retracement resistance is 1.3148.

USD/JPY backed off one-week highs as focus turned to today’s BoJ meeting. EUR/JPY and GBP/JPY are both trading near their 200-day SMAs. No changes are expected at the central bank gathering. Policymakers will await the spring wage negotiations before any chance of the next rate hike. See below for more detail.

AUD fell back after its break higher on Monday. The low key risk mood didn’t help the high beta cyclical currency. USD/CAD nestled just above 1.43 The trim and median core measures remained below 3.0%, though beat estimates. Support sits at 1.4368.

US stocks: The S&P 500 lost 1.07% to settle at 5,614. The tech-heavy Nasdaq finished down 1.66% at 19,483. The Dow fell 0.62% to close at 41,581. Communication services, consumer discretionary, staples and tech were the big losers. Only healthcare and energy were in the green. Nvidia shares closed in the red (-3.43%) despite a slew of announcements at the Global AI conference (GTC). Tesla was among the steepest decliners again, down over 5.4%, as it nears the recent low at $217, a level last seen in October. The EV-maker extended the recent decline that has brought it down by half from its December peak. The Mag 7 group of tech megacaps is now down roughly 18% since the S&P 500 hit a record high on February 19. A Bank of America survey released yesterday showed investors made the biggest ever cut to their US equity allocations in March.

Asian stocks: Futures are in the red. APAC stocks were generally higher. The ASX 200 gave back some of its gains through the session. Losses in tech offset energy strength. The Nikkei 225 moved towards 38,000 with strength in trading houses after Berkshire Hathaway boosted its stake in the five biggest. The Hang Seng and Shanghai Comp were mixed with the former making a fresh three-year high. Tech outperformed with Baidu leading the advances after its recent AI model launch.

Gold broke sharply to the upside and decisively through the psychological $3,000 barrier. Yields were muted, along with the dollar as risk sentiment remained subdued.

Day Ahead –BoJ and FOMC Meetings

The Bank of Japan will conclude a two-day policy meeting with a rate decision. Anything but a hold would be a big surprise after the January rate hike, trade war tensions and a stronger yen. The latter will serve to dampen imported inflation. With the outlook for another significant wage increase this year, any guidance on the timing of the next rate hike will lift JPY. The BoJ is expected to find room to hike rates again over the summer.

The Fed is fully expected to keep the current target range on hold at 4.25-4.50%. The statement and Chair Powell are likely to reiterate that rate setters are in no rush to reduce rates. No major changes are predicted with the updated quarterly dot plot and economic projections, with time needed to assess the uncertainty of Trump’s policies. The most recent December forecast saw two 25bps rate cut in 2025. There may be a downgrade in growth and upward revision to inflation for 2025.

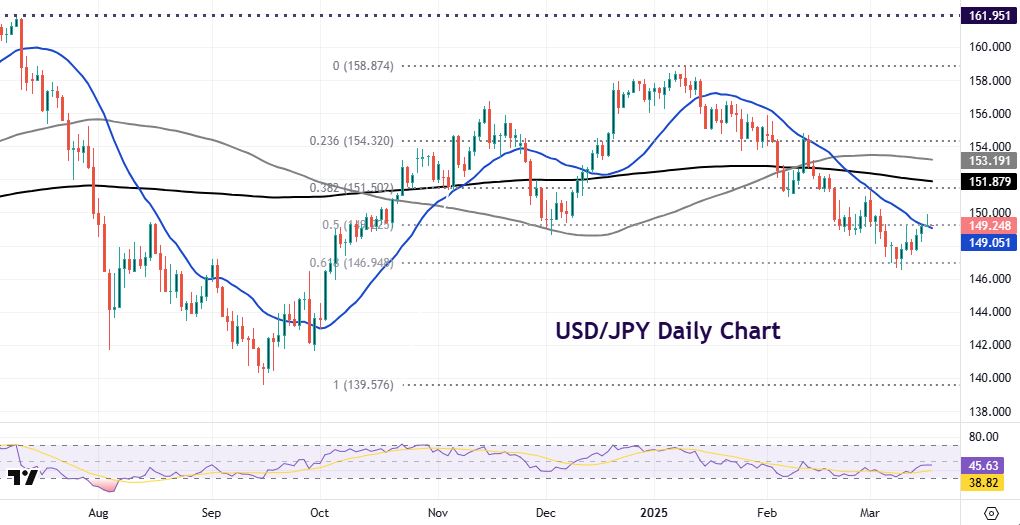

Chart of the Day – USD/JPY remains in long-term downtrend

The BoJ and Fed meetings on the same day is relatively rare. That means there could be volatility in the major currency pair. While no policy changes are expected, any guidance from either central bank about where respective rates go would move prices. A need for patience is likely to continue to dominate overall Fed messaging, with perhaps a mild emphasis on upside risks to inflation. That could help support the beleaguered dollar as it could reduce projected easing. The BoJ test will be if there is any guidance on the next rate hike. Half of a 25bps move is priced for the June meeting.

USD/JPY has moved lower in a bear channel since topping out in early January at 158.87. Prices have tried to move out of that pattern very recently, having hit the 50-day SMA at 149.40 and the halfway point of the September to January rally at 149.22. The recent low is near the Fib below at 146.94. The next upside resistance level is 151.50.