Risk-off trade amid US-China tensions

- Dollar weakens on trade tensions, Fed Chair Powell’s caution

- Powell says Fed to stay on hold until clarity on tariff impact

- Equity markets drop as Nvidia tumbles, Powell quips

- Gold rises to new record in best day since April 2020

FX: USD fell back to recent lows as it settled at it levels last seen in April 2022. The intraday y-t-d bottom is just below at 99.01. A ratcheting up in US-Sino trade tensions hit the risk sentiment and the buck. The US put export restrictions on certain chips to China while President Trump launched more investigations into national security risks. Both countries seem fixated on company-specific exports to punish each other. Notably, the dollar fell as the risk mood deteriorated, so playing once again not acting as a safe haven. Fed Chair Powell maintained his wait-and-see approach.

EUR led the gains along with CHF as it settled just below 1.14. Final euro area March CPI figures were in line with expectations (2.2% y/y headline, 2.4% y/y core), and rate expectations for today’s ECB meeting have remained largely unchanged pricing with one full 25bpt cut priced in for the meeting. The market narrative around trade continues to dictate near-term movement in EUR as tensions provide support and easing concerns provide for consolidation. See below for more on the major and the meeting.

GBP popped higher to a six-month peak at 1.3291 before paring gains, though cable closed in the green for a seventh straight day. The CPI release for March disappointed slightly on headline (2.6% y/y vs. 2.7% y/y expected.) and came in as expected on core (3.4%).

USD/JPY fell to a fresh low at 141.63, as bears closed in on 139.57, the bottom from September 2024. The risk-off mood helped the yen. Japan’s chief trade negotiator is visiting Washington for talks with his US counterparts. President Trump is also set to be attending the meeting. Japan’s recent performance has largely been driven by trade tensions with notable gains on the particularly volatile sessions of April 3 and 10.

AUD enjoyed a sixth straight day of buying as it continued to rebound. There is strong resistance just below 0.64. CAD strength was present both before and after the BoC’s decision to hold rates. Expectations going into the event were pretty much split between a hold and 25bps rate cut, with BoC Governor Macklem noting the decision to hold came as they want to gain more information about the path of US tariffs and the impact they will have. Rates are exactly in the middle of the neutral range. Support is at 1.3850/60.

US stocks: The S&P 500 lost 2.24% to settle at 5,275. The tech-dominated Nasdaq finished down 3.04% at 18,257. The Dow closed 1.73% lower at 39,669. The US put export restrictions on certain Nvidia and AMD chips to China following the recent halt China imposed on Boeing deliveries. The latter update weighed on chip names, with Nvidia off 6.87%, AMD and INTC tumbling. This saw tech post the largest losses in the sector space, while the Nasdaq underperformed. The majority of sectors were in the red, with the large-cap sectors weighing but with outperformance in energy as crude prices were buoyed. Upside in crude started on Bloomberg reports that China is open to talks with the US, but only if US President Trump shows respect. Crude prices continued to gain after the US issued fresh Iran-related sanctions, including on a Chinese refiner said to be buying Iranian crude. The downside in stocks accelerated after Fed Chair Powell spoke, where he continued to tow the line that patience is needed until they get more clarity on the impact of tariffs.

Asian stocks: Futures are mixed. APAC stocks were mostly subdued following the choppy and rangebound performance Stateside. There were mixed data releases, but the mostly better-than-expected Chinese GDP and activity data failed to lift positive risk sentiment. The ASX 200 clawed back losses amid strength in gold miners, consumer staples and financial but gains were limited by weakness in miners. The Nikkei 225 edged lower beneath the 34,000 level amid the ongoing global trade war concerns and despite encouraging Machinery Orders. The Hang Seng and Shanghai Comp underperformed amid US-China trade frictions. The US said it will require a licence for Nvidia to export H20 processors to China. Mostly better-than-expected GDP and activity data from China failed to inspire due to the reporting date being before the US-China tariff escalation.

Gold jumped higher hitting fresh record highs once more and closing very close to this top at $3,343. Bullion is up 25% year-to-date as investors continued to flock to safe havens.

Day Ahead – ECB Meeting

Expectations are for the ECB to cut the deposit rate by 25bps to 2.25%. With the growth very clouded by tariff uncertainty, policymakers are set to take action by loosening monetary policy further. The Governing Council statement is likely to reiterate that monetary policy is becoming meaningfully less restrictive and officials will follow a data-dependent and meeting-by-meeting approach. It would be a big surprise if the bank inserts any additional language or guidance due to the ongoing trade war.

The upcoming meeting will not be accompanied by any quarterly staff economic projections. The backdrop to the meeting has obviously been dominated by Trump’s trade agenda. Currently, he has announced a 90-day pause in tariff actions and cut reciprocals to 10% for nations that asked for talks. Overall, the outlook for trade has improved over the past few sessions, but it remains highly uncertain and therefore continues to suppress the growth outlook for the region.

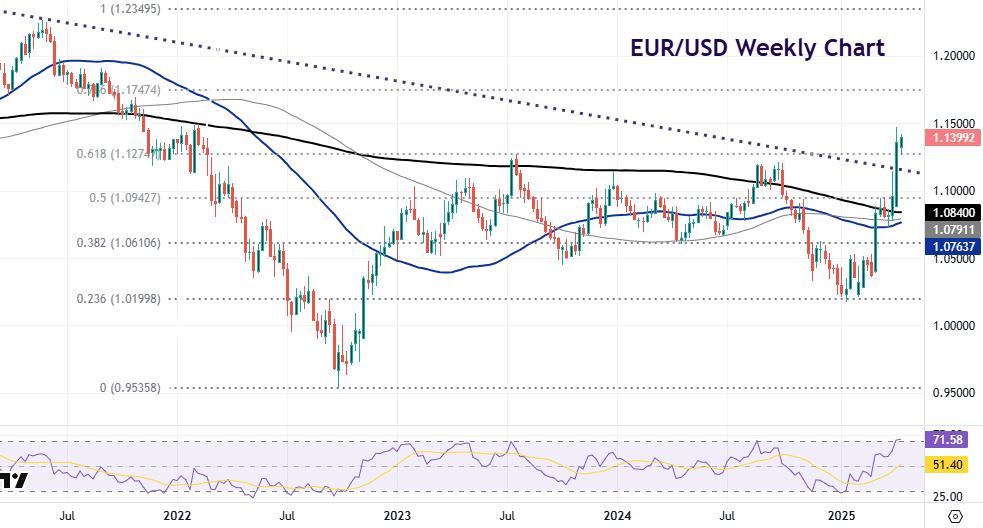

Chart of the Day – EUR/USD bulls in charge

The world’s most popular currency major has soared in recent weeks. The US growth outlook has collapsed, and a sharp dislocation in US asset markets has questioned the dollar’s safe haven role. Investors have either raised dollar hedge ratios or have repatriated US assets completely. Ultimately, lower US growth rates are coming and Federal Reserve rate cuts in the second half of this year will hit the dollar broadly.

Meanwhile the euro has benefitted as a major liquidity alternative to the greenback. That said, the ECB could keep cutting after today’s move, with rates falling to 1.75% with two more cuts across two quarters. Bulls will target the 1.15 round number, just above the cycle top at 1.1473. There is major support just below 1.13.