Gold shines, stocks sink amid ongoing, escalating trade war

- USD rises but remains pressured against peers with tariffs in focus

- Wall Street tumbles as S&P 500 slips into correction territory

- Gold traded to new record highs as inflation slows and stocks fall

- Tesla warns Trump it is “exposed” to retaliatory tariffs

FX: USD gained for a consecutive day, but it failed to close above 104 on the Dollar Index. As we have been saying, there is a lot of negative news in the dollar, especially with regard to a recession. These slowdown calls have often been misplaced regarding the US. The greenback also reverted to type with regard to the risk mood, with investors buying the buck as stocks tanked. The rest of the world normally ‘catches a cold’ if the US economy also struggles. There could also be a tipping point for the US administration in terms of how much pain they see in equity markets, even though they may not say it explicitly at the moment.

EUR traded lower for a second day, no real surprise after its stunning run higher. The secular mood change regarding the removal of the German fiscal debt brake, plus more upbeat news on a Ukraine ceasefire has been historic. Russia now appears to be playing hardball and a lot (of peace) appears to be in the price. Any stumbling to get the German shift enacted into law is also giving markets a reason to book profits.

GBP tracked the broader risk mood with a modest down day. The BoE’s cautious rate cutting approach may also be helped the pound. UK GDP is released later today – see the preview on that and GBP/USD below. EUR/GBP turned lower again for a third straight day. We warned that was possible after resistance just below the January year-to-date high at 0.8473.

USD/JPY headed back to the major retracement level of that rally (61.8%) at 146.94 as the yen outperformed. This was initially helped by comments from BoJ Governor Ueda who talked up real wages and consumption. That could potentially push the bank into more policy tightening soon.

AUD suffered on poor risk sentiment but still trades around the 50-day SMA, now at 0.6312. An electricity price hike could hit consumers. USD/CAD made back most of Wednesday’s losses and the BoC meeting. Of course, tariffs took centre stage with so much uncertainty clouding the bank’s outlook. There’s roughly 45bps of BoC rate cuts currently priced in by markets by year end.

US stocks: The S&P 500 lost 1.39% to settle at 5,521. The tech-dominated Nasdaq finished down 1.89% at 19,225. The Dow fell 1.30% to close at 40.813. Yesterday saw the benchmark and broad-based S&P 500 fall into correction territory on a closing basis – that’s down 10% from the record high and equates to about $500 trillion in market value from the February top. Tech and Mag 7 stocks got hit with defensives slightly reversing the previous day’s rotation. The measured move of the double top in the Nasdaq points to a target of 18,854. Intel jumped 14.6% as it appointed an industry veteran as its new CEO.

Asian stocks: Futures are negative. APAC stocks were muted on Thursday despite a decent handover from Wall Street. The ASX 200 was dragged lower by energy and financial. Electricity bills are to jump as much as 9% in another cost-of-living blow. The Nikkei 225 initially pushed above 37,000 but gave up those gains by the close. The Hang Seng and Shanghai Composite were downbeat after a tepid PBoC liquidity operation.

Gold broke to new record highs as we thought was likely in our daily commentary yesterday. Haven buying was to the fore on the sharp stock sell-off, amid Trump tariff threats. These have boosted inflation expectations with geopolitical uncertainty front and centre.

Day Ahead –UK GDP

January UK growth is forecast to slow two-tenths to 0.2%. The December reading meant Q4 q/q growth printed at 0.1%, just above the prior flat quarter. Monthly GDP numbers can be notoriously volatile, but a retracement of the big December rise is likely. That 0.4% print was the strongest in nine months. Strong retail sales should help the service sector, but PMIs and business confidence indicators are less positive and will likely counter that retail activity.

The UK is set for a big fiscal event with the upcoming 26 March budget. This could see the Chancellor have to announce either tax rises or spending cuts. Before that, next week sees the latest employment data just a few hours before the BoE meeting. No rate cut is forecast but a dovish hold is on the cards with market expectations lining up a move in May or definitely by June.

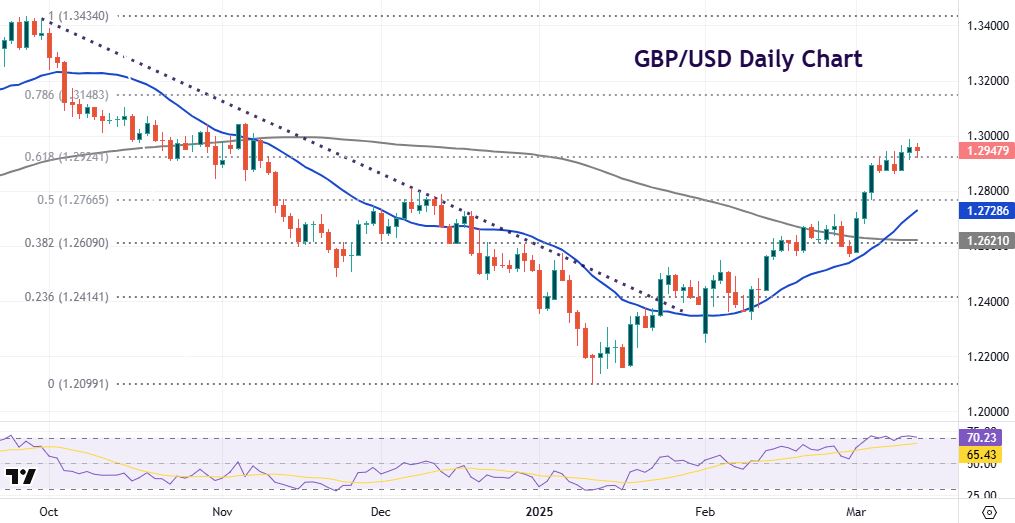

Chart of the Day – GBP/USD overbought but strong bullish momentum

Sterling has continued to be led higher in recent weeks by events across the channel in Germany and the eurozone. Consolidation around 1.26 towards the end of February saw a bullish break higher above the 100-day SMA. Three strong days of buying took cable through 1.28 and very recently above 1.29. Wednesday saw highs at 1.2987, a level last seen in early November. we are currently trading just above a major Fib level of the September to January decline (61.8%) at 1.2924. We could see a correction as we are overbought on several momentum indicators. The midpoint of that autumn sell-off is 1.2766. Resistance is 1.30 ahead of a push to 1.3148.