Choppy trade in stocks and USD amid tariff noise

- Dollar slides, EUR and GBP rise while CAD is hit on auto tariffs

- Equity markets drop after Trump’s latest levy volley

- Gold makes fresh record highs as trade tension mounts

- US seeks to control investment in Ukraine, IMF doesn’t see US recession

FX: USD erased the prior day’s gains as auto tariff confirmation from President Trump upended the buck. He also reiterated levies coming on pharma and timber. Growth concerns in the US are front and centre even though Trump said April 2 reciprocal tariffs could be “very lenient”. Next up is core PCE inflation data with Fed Chair Powell post -FOMC recently stating the headline likely rose 2.5% in February and core 2.8%.

EUR snapped its six-day losing streak with all eyes on US tariffs on the EU. Media reports suggest the range will be between 20-25%. The question will be how the zone retaliates, which seems likely, and then how Washington responds. A global trade war is bearish for the cyclically sensitive euro. The 200-day SMA sits at 1.0729.

GBP moved back above the 1.29 handle with the recovery from Wednesday’s sell-off in play. There is little sterling news, with commentary very much digesting the Spring Statement and tariff implications. Sterling is seen as less exposed to tariff noise.

USD/JPY moved higher to the topside and closer to next major resistance around the 50-day and 200-day SMA, and a major Fib level around 151.50. Fresh macro drivers for Japan were light as markets looked ahead to Tokyo CPI.

AUD printed an inside day as prices consolidated in a narrow range around the 50-day SMA at 0.6295. USD/CAD moved above the 100-day SMA at 1.4262. Strong support is the major Fib level (38.2%) of the September/February rally at 1.4268.

US stocks: The S&P 500 lost 0.33% to settle at 5,693. The tech-dominated Nasdaq finished down 0.59% at 19,799. The Dow closed 0.37% lower at 42,300. Energy, communication services and technology were the laggards while consumer staples outperformed with only consumer discretionary and healthcare the other sectors in the green.

Asian stocks: Futures are mixed.APAC stocks were ultimately mixed with cautiousness seen after Trump’s latest tariff announcement. The ASX 200 slid with the index dragged lower by underperformance in tech, real estate and financials. But strength in utilities and the commodity-related sectors offset losses. The Nikkei 225 slipped back beneath the 38,000 level with automakers among the worst hit following Trump’s 25% auto tariff announcement. The Hang Seng and Shanghai Comp were kept afloat with outperformance in Hong Kong amid a slew of earnings releases. US President Trump also suggested he may give China a little reduction in tariffs to get a TikTok deal done.

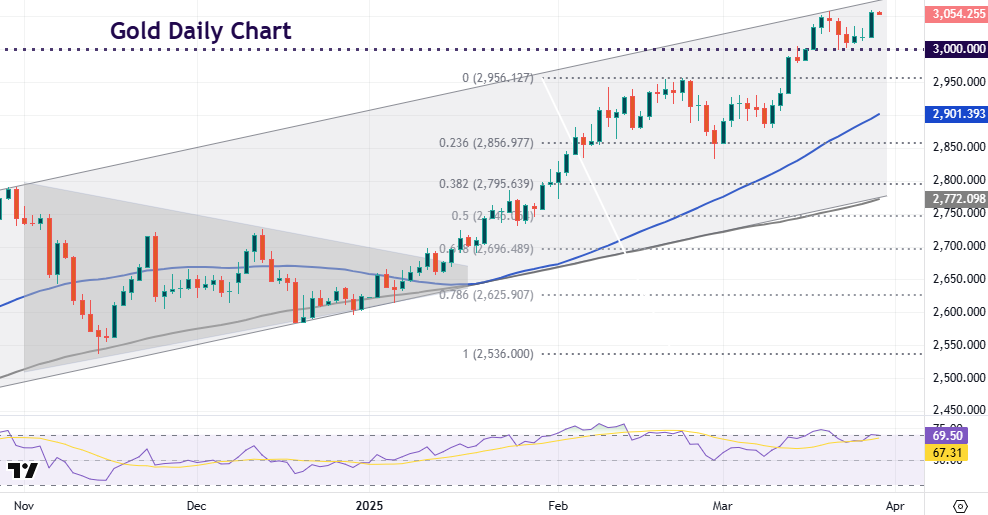

Gold broke higher and printed a new all-time high at $3059.

Day Ahead – UK Retail Sales, US Core PCE

After the UK Spring Statement avoided any bond market fireworks, we go back to data releases with focus on retail sales figures. Expectations are for February activity to print flat, down from the 1.7% in January. Survey data has been flat too with other indicators mixed, as consumers hunker down ahead of April’s rise in various utility bills. GBP survived Wednesday’s fiscal event, but tax rises might be coming to the UK in the Autumn with potentially more BoE policy easing needed.

The Fed’s favoured inflation gauge is seen steady at 0.3% m/m and 2.7% y/y. Headline PCE is forecast at 0.3% m/m and 2.5% y/y. The Fed upwardly revised its projection of the core metric to 2.8% from 2.5% at its March meeting. Personal income and spending will also grab some attention. These are forecast to rise, supported by solid job and wage growth. The Fed is currently taking a back seat to tariff noise with roughly 63bps of rate cuts priced in. That means around a 50% chance of a third 25bps move. We note that last week, Chair Powell did mention that tariff inflation is “transitory”.

Chart of the Day – Gold jumps as we get closer to Liberation Day

After recent consolidation above $3000, gold bugs pushed prices to record highs once again. There is obviously much uncertainty in markets surrounding tariffs and future Trump policies. That goes for increasing geopolitical risks too, which have seen the prospect of rate cuts by major central banks remain in the pipeline. Central banks are still stocking up on supply, with the PBoC resuming buying a few months ago. Robust ETF demand also continues to support prices. Goldman Sachs recently raised its year-end 2025 projection to $3,300 citing stronger than expected ETF and central bank buying. Bullion remains in a long-term uptrend near the top of the channel.