Trump’s tariff plans are likely to continue drawing market attention next week. Owing to the fear and uncertainty over what Trump may do next, traders could overlook two key releases next week – the US CPI and FOMC minutes. However, stay sharp and keep focused as FOMC minutes and CPI still have the potential to drive major market moves amidst all the chaos.

CPI & FOMC: The Market Movers You Can’t Ignore

You can think of the Federal Open Market Committee (FOMC) as the biggest mover of global markets. The Fed is charged with making decisions on interest rates and US monetary policy, hence, the minutes from their meeting give us insights into their judgement of how the largest economy in the world is performing and how they may react.

In the March meeting, the Fed kept in line with expectations by keeping rates unchanged and forecasting two rate cuts this year. However, they did add that “uncertainty around the economic outlook has increased”. One major source of that uncertainty? Tariffs.If the Fed has reason to believe that tariffs will drive inflation out of control again, they could pivot to slow down the pace of rate cuts and even keep rates higher for longer.

One key indicator at the top of the Fed’s mind will be CPI – a marker of inflationary pressure in the US. The last print in February hinted at cooling price pressures, where CPI rose just 0.2% month-over-month (MoM), bringing year-over-year (YoY) inflation to 2.8%, slightly below expectations. However, just when everyone thought inflation was on a leash, Trump-era tariffs came crashing back into the picture to stoke fears of a price surge. If the US March CPI comes in hot, the Fed may face a balancing act between managing inflation risks and supporting economic growth.

EURUSD: Can prices sustain gains?

Germany’s recent boost to defence spending has bolstered expectations for the region’s recovery and freed up €500bn for German infrastructure, prompting the recent rally in EURUSD. If the U.S. March CPI surprises to the upside, the Fed may be forced to rethink its easing plans, risking market volatility and renewed USD strength, which could temper the upward momentum of EURUSD. However, if US CPI remains soft, the path to rate cuts stays open, introducing an outlook for EURUSD that is more mixed in comparison.

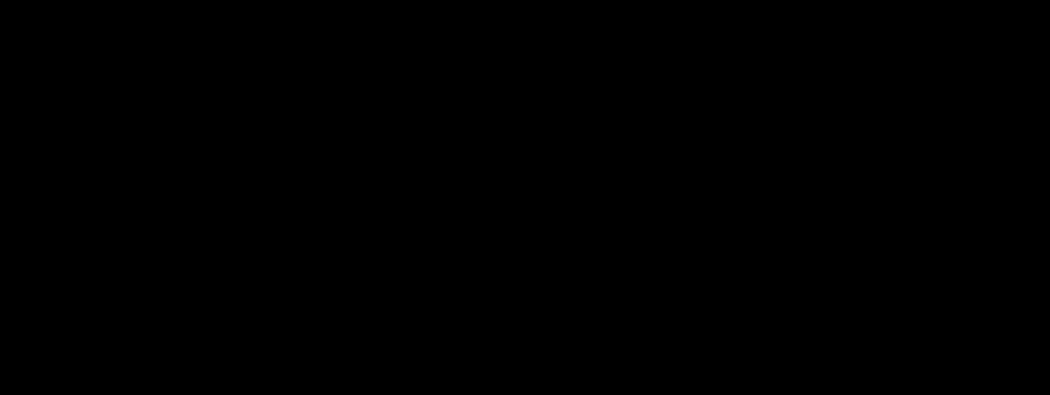

Ticker: EURUSD, Timeframe: Daily

Bullish momentum has returned for the EURUSD from the start of the year, as the price holds above the Ichimoku Cloud and ascending trendline. The price is now retracing and looking to retest the 1.0750 support in line with the 161.8% Fibonacci extension. If current momentum persists, it could prompt a further move to resistances at 1.1050 and 1.1200, in line with the previous highs. However, a deeper retracement and bearish breakout of the trendline could see the price retest the 1.0500 support level in line with the 161.8% Fibonacci Retracement.

USDCNH – Keep an eye out for PBoC’s movements

Amid all the noise last week, one key move may have flown under the radar as the People’s Bank of China (PBoC) seems to be loosening its grip on the Chinese yuan. In other words, it is letting the currency move a bit more freely than usual.

As USDCNH 1-month volatility remains relatively low, it signals that most traders have not been watching the pair as its movements have been minimal at best. Keep an eye out for this pair as – further yuan weakness driving USDCNH bullish momentum beyond 7.37, near levels where the PBoC has intervened before, will be interesting.

A hotter US CPI print could raise the risk of the Fed holding rates higher for longer. That might give the USDCNH an initial boost, but if recession fears flare up, it could drag on broader risk sentiment, leaving the price stuck in a choppy range unless the PBoC steps in with weaker fixings. Meanwhile, a softer US CPI print could provide a relief for recessionary worries and take some heat off the USD, thereby supporting the bullish momentum in USDCNH.

Ticker: USDCNH, Timeframe: Daily, Source:

From a technical perspective, USDCNH has broken above the descending trendline and now holds above the Ichimoku Cloud. Further bullish momentum could see the price test the 7.3650 resistance in line with 61.8% Fibonacci Extension and the 7.4100 resistance, which aligns with the 50% and 100% Fibonacci Extensions. However, any bearish pivot could see price retest supports at 7.2800 and 7.2250.

Watch out for CPI and FOMC minutes and the potential for higher volatility in the market once the Fed’s stance is revealed. Keep in mind that movements may be muddied by headlines over Trump-era tariffs, so stay nimble and ready to adapt to major price movements.