Trump’s trade tariffs are triggering a trade war between two of the largest economies in the world. This development is understandably spooking markets worldwide. While you may be anxious about protecting your portfolio, it’s crucial to stay calm and look beyond the current chaos to see where things are really going. This will help you better capitalise on future opportunities.

To that end, let’s take a look at how global trade is likely to be reshaped in light of the newly announced trade tariffs.

Key Points

- US tariffs have heightened market volatility and raised concerns about long-term economic growth.

- Asia is emerging as a trade beneficiary, attracting investment and supply chain shifts away from China.

- Emerging markets are gaining traction as investors seek diversification and higher growth potential outside the US.

US Markets – Is the growth story slowing down?

Trump’s trade tariffs are aimed at benefiting the US economy by making foreign imports more expensive. This is believed to allow domestic companies to compete more fairly, bring jobs back to the US, and encourage Americans to buy local, thereby fostering economic growth.

However, economists disagree. They instead state that raising the price of goods from overseas will increase inflation and drag down economic growth. Indeed, analysts at the Tax Foundation forecast a drop in GDP by as much as 1% for 2025 [1].

This view is echoed by researchers from Australia’s Victoria University, who estimated a 2% GDP drop in 2% GDP drop for the year, with persistent long-term economic decline averaging 1.6% GDP loss over the next 15 years [2].

These numbers could illustrate why Trump u-turned on his brutish approach with a 90-day pause; it is clear that economic impact to the US would be severe and long-lasting, and such economic considerations are likely to prompt further adjustments down the line.

But what does it mean for the US economy, especially over the long term? Well, we’ve already seen sharp drops in the Big 3 market indicators – S&P 500, Nasdaq and Dow Jones – followed by a relief rally upon the announcement of the 90-day pause.

Such near-term volatility is a clear signal of the market’s disdain for Trump’s policies – and does little to promote investor confidence.

The fact is US market watchers are in for a period of heightened uncertainty. Trade tariffs – especially those on the scale being sought after by Trump – can have far reaching and unpredictable consequences on the US economy.

This coming period of economic uncertainty is prompting investors to hedge against risk, leading to rising interest in portfolio diversification. The question is, where should investors look to next?

Asia – Why it’s back in the spotlight

At the time of writing, Trump’s administration has set total tariffs at 145% on goods from China – while temporarily keeping tariffs at a relatively breezy 10% for other countries.

While it is still uncertain where tariffs will end up, ultimately Trump’s trade policies will cause a change in global trade by shifting supply chains away from China. This will benefit Asia, which has several countries well-positioned to take over orders.

Businesses seeking to avoid tariffs may choose to source from other suppliers in Asia. Even if these countries charge a higher price, businesses would still be profitable as long as costs are far enough below the tariff rate.

Additionally, businesses may also open manufacturing plants in Asia to perform final assembly before being exported. This could allow them to still benefit from cheaper raw materials and basic components from China, while enjoying lower tariffs for export to the US due to the final product’s country of origin.

With higher foreign domestic investment inflows, and greater orders from American and multinational companies, Asian economies may experience higher economic growth and development if these shifts materialise.

This potential development has led to greater interest in Asia from global investors.

Spotlight on Japan, China, and Hong Kong

In particular, Japan, China, and Hong Kong are emerging as key markets amid shifting global trade dynamics. Here’s a quick breakdown for each:

Japan: Seeking Stability Amid Uncertainty

Japan’s Nikkei225 was not immune to the global market turmoil. Although Japan sought to engage in trade talks with the US to mitigate the impact of the tariffs, deep-rooted economic issues such as weak inflation and wage growth continue to put Japan on the slow path to monetary policy normalisation.

Given Japan’s ultra-loose monetary policy versus tightening in the US and Europe, the Nikkei225 allows for carry trade opportunities via Nikkei-linked futures. Also, in times of US tech pullbacks, the Nikkei often moves differently due to its sector mix (more industrials, fewer hyper-growth names), making it an attractive alternative amidst an uncertain US outlook.

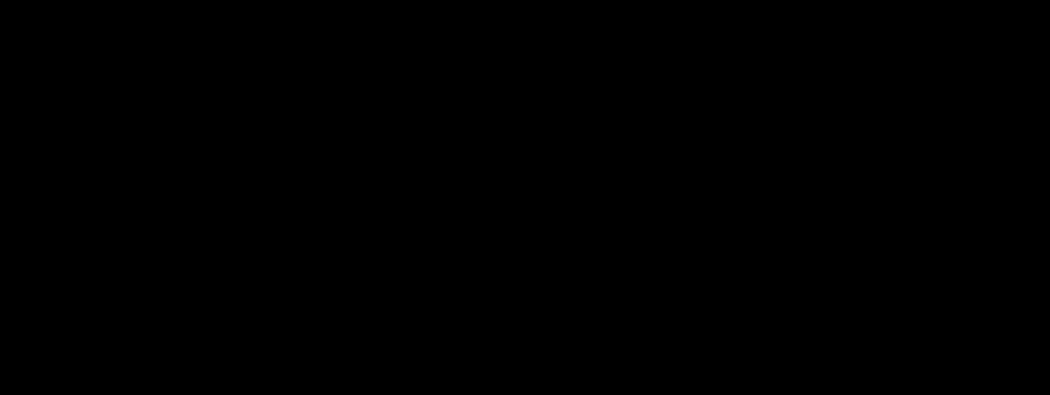

Japan’s Nikkei 225 also saw a strong push towards the downside and is now pulling back towards the 36,200-point level, in line with the 78.6% Fibonacci Retracement level. Further resistance levels at 38,100 points and 40,200 points, in line with swing highs, could be tested in the case of a bullish recovery. In the event of further bearish momentum, the price will likely push lower towards the 31,500 points support in line with 78.6% Fibonacci Retracement and 50% Fibonacci Extension.

Hong Kong: Weathering the Storm

Hong Kong’s Hang Seng Index experienced its most significant one-day drop since the 1997 Asian Financial Crisis amid escalating trade tensions. However, the market showed resilience, aided by regional market gains and efforts by Beijing to stabilize markets.

In comparison to Chinese indices, the HSI gives you access to Chinese companies but with fewer domestic regulatory restrictions. This means that a wider range of investor types can participate in China through the HSI, providing greater liquidity.

Ticker: HSI, Timeframe: Daily

HSI also remains in bearish territory, holding below the 50-day MA. A pullback towards the 22,600 points resistance could be possible – an area of Fibonacci confluence in line with the 61.8% Fibonacci Retracement and 127.2% Fibonacci Extension. We could see price retest lower support levels at 19,000 and 17,000 points. Any stronger retracement towards the upside could see the price retest the swing high at 24,700 points.

China: Navigating Turbulent Waters

China’s stock markets faced sharp declines following the US announcement of increased tariffs. In the wake of tariff announcements, Chinese stock indices dropped over 7% daily, reflecting investor concerns over the trade dispute.

In response, Beijing implemented measures to stabilise the markets, including support from state-owned entities and pledges of economic stimulus, but showed resolve against backing down, implementing a 125% tariff against the US. These actions contributed to a modest recovery, but only time will tell how much more pressure Trump is willing to place on Beijing.

The China 50 is one of the most liquid instruments for accessing Chinese equity risk, with strong intraday movements that appeal to active traders. It’s a top-down proxy for sentiment on the world’s second-largest economy, whether you’re trading based on PMI data, yuan devaluation, or geopolitics.

Ticker: CHINA50, Timeframe: Daily

China 50 remains pressured by bearish momentum and is now testing pullback resistance at the 13,000-point level, in line with 61.8% Fibonacci Retracement and 127.2% Fibonacci Extension.

With further bearish momentum, we could see the price push lower towards the 11,800 and 11,000 points support levels, in line with 61.8% and 100% Fibonacci Extension levels. However, a deeper retracement could see the price push higher towards the 13,800 points high.

The rise of emerging markets

Apart from Asia, emerging markets may also benefit from the evolution of global trade practices.

Emerging markets are defined as developing nations that are undergoing rapid industrialisation and economic growth, transitioning into a developed economy. Typically, such economies have high levels of investment, productivity and exports. Some examples of emerging markets include Brazil, India, Mexico, Egypt, Turkey, South Africa, and Vietnam.

With well-developed infrastructure, many emerging economies – both in and outside of Asia – are well-poised to take over orders, gaining strong drivers to their economic growth.

Additionally, emerging economies are characterised by high population growth and increasing affluence – key factors for high economic growth that outpaces those of developed countries.

In 2025, emerging economies are projected to grow 4.3%, outpacing developed markets at 1.6%, according to a report from Swiss analyst Pictet Asset Management. [3]

Exposure to emerging economies can be accessed through ETFs or CFD instruments that track their performance, subject to availability and local regulations. One such example is the iShares MSCI Emerging Markets ex China ETF (EXMC), which allows exposure to emerging economies without Chinese markets.

Emerging Markets Case Study: Charting a Course through Uncertainty

For an even broader exposure across emerging markets, An example of such an ETF is the iShares MSCI Emerging Markets Index Fund (EEM), which some traders may access via CFD products depending on availability and local regulations. EEM offers exposure to over 800 large- and mid-cap companies across more than 20 emerging economies, including powerhouses like China, India, Brazil, and Taiwan. This diversification can help mitigate volatility and enhance potential returns for retail traders.

EEM shows a similar price structure to other indices in this article. Bearish momentum is pushing price lower to test supports at the $38.50 swing low, in line with the 50% Fibonacci Extension. Price is now pulling back to $42.80 resistance, in line with the 61.8% Fibonacci Retracement and 100% Fibonacci Extension. Any further pullback could see price retest the swing high at $45.50, in line with the 161.8% Fibonacci Extension.

Final thoughts: Rebalancing for global opportunities

While the US markets have long captured investor attention, the risk of a US-China trade war and resulting economic slowdown cannot be ignored. Investors may consider exploring opportunities beyond the US, in regions like Asia and other emerging markets, as part of broader diversification strategies.

Considering different investment options is important, given the fluid nature of global markets. It is important to stay informed about global events and continually educate yourself on evolving market trends.

Stay informed with Vantage’s education hub featuring the latest news, articles and market resources, and put your strategies into action with our advanced trading platforms. Sign up for a live account today!

References

- “Trump Tariffs: The Economic Impact of the Trump Trade War – Tax Foundation”. https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/ . Accessed 14 April 2025.

- “This chart explains why Trump backflipped on tariffs. The economic damage would have been huge – The Conversation”. https://theconversation.com/this-chart-explains-why-trump-backflipped-on-tariffs-the-economic-damage-would-have-been-huge-253632 . Accessed 14 April 2025.

- “Emerging Markets Offer Safe Haven from Trump Tariffs: Swiss Analyst – Yahoo!Finance”. https://finance.yahoo.com/news/emerging-markets-offer-safe-haven-120000559.html . Accessed 14 April 2025.